Page 70 - Understanding Economics for Class 10

P. 70

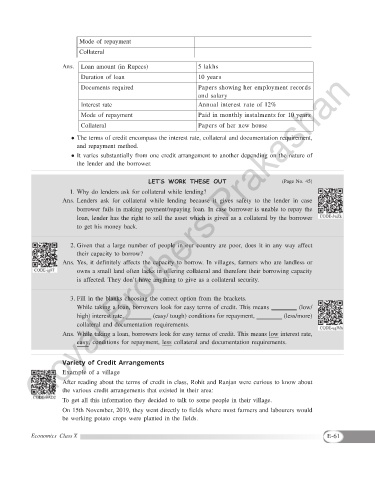

Mode of repayment

Collateral

Ans. Loan amount (in Rupees) 5 lakhs

Goyal Brothers Prakashan

Duration of loan 10 years

Documents required Papers showing her employment records

and salary

Interest rate Annual interest rate of 12%

Mode of repayment Paid in monthly instalments for 10 years

Collateral Papers of her new house

The terms of credit encompass the interest rate, collateral and documentation requirement,

and repayment method.

It varies substantially from one credit arrangement to another depending on the nature of

the lender and the borrower.

LET’S Work ThESE ouT (Page No. 45)

1. Why do lenders ask for collateral while lending?

Ans. Lenders ask for collateral while lending because it gives safety to the lender in case

borrower fails in making payment/repaying loan. In case borrower is unable to repay the

loan, lender has the right to sell the asset which is given as a collateral by the borrower

to get his money back.

2. Given that a large number of people in our country are poor, does it in any way affect

their capacity to borrow?

Ans. Yes, it definitely affects the capacity to borrow. In villages, farmers who are landless or

owns a small land often lacks in offering collateral and therefore their borrowing capacity

is affected. They don’t have anything to give as a collateral security.

3. Fill in the blanks choosing the correct option from the brackets.

While taking a loan, borrowers look for easy terms of credit. This means ________ (low/

high) interest rate, ________ (easy/ tough) conditions for repayment, ________ (less/more)

collateral and documentation requirements.

Ans. While taking a loan, borrowers look for easy terms of credit. This means low interest rate,

easy, conditions for repayment, less collateral and documentation requirements.

variety of credit arrangements

Example of a village

After reading about the terms of credit in class, Rohit and Ranjan were curious to know about

the various credit arrangements that existed in their area:

To get all this information they decided to talk to some people in their village.

On 15th November, 2019, they went directly to fields where most farmers and labourers would

be working potato crops were planted in the fields.

Economics Class X E-61