Page 80 - Understanding Economics for Class 10

P. 80

(iii) Explain with an example how the terms of credit can be unfavourable for the small farmer.

(iv) Suggest some ways by which small farmers can get cheap credit.

Ans. (i) Banks might be unwilling to lend to small farmers because of the following reasons:

(a) Small farmers do not have any collateral to offer

Goyal Brothers Prakashan

(b) They lack in their repaying capacity

(c) They are not able to complete paper formalities

(d) Since farmers needs loan for cultivation which involves high risk. Whether production

will be good or not is completely uncertain.

(ii) Other sources from which the small farmers can borrow are money lenders, traders, friends,

relatives etc.

(iii) If a small farmer borrows money from a bank, he has to repay the amount at a fixed rate

of interest. For example, if a farmer borrows money from the bank and, during the harvest

season, their crops are ruined, then he might not be able to repay the amount loaned to

him by the bank and will further fall into the debt trap. If he has offered collateral at the

time of taking loan then bank has all the right to confiscate his asset to recover its money.

(iv) Small farmers can make their own groups just like SHGs to get cheap credit. They can

take cheap laon from formal sources like banks and cooperatives.

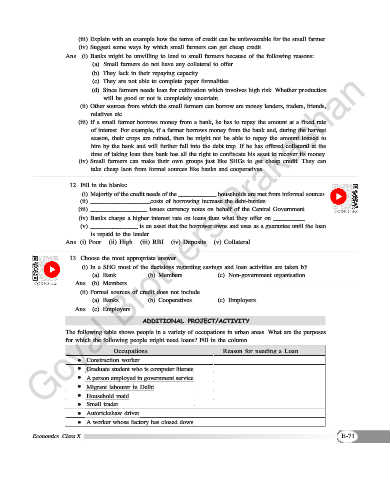

12. Fill in the blanks:

(i) Majority of the credit needs of the ____________ households are met from informal sources.

(ii) ___________________costs of borrowing increase the debt-burden.

(iii) __________________ issues currency notes on behalf of the Central Government.

(iv) Banks charge a higher interest rate on loans than what they offer on __________.

(v) _______________ is an asset that the borrower owns and uses as a guarantee until the loan

is repaid to the lender.

Ans. (i) Poor (ii) High (iii) RBI (iv) Deposits (v) Collateral

13. Choose the most appropriate answer.

(i) In a SHG most of the decisions regarding savings and loan activities are taken by

(a) Bank. (b) Members. (c) Non-government organisation.

Ans. (b) Members

(ii) Formal sources of credit does not include

(a) Banks. (b) Cooperatives. (c) Employers.

Ans. (c) Employers

ADDitionAL ProJeCt/ACtiVitY

The following table shows people in a variety of occupations in urban areas. What are the purposes

for which the following people might need loans? Fill in the column.

Occupations Reason for needing a Loan

Construction worker

Graduate student who is computer literate

A person employed in government service

Migrant labourer in Delhi

Household maid

Small trader

Autorickshaw driver

A worker whose factory has closed down

Economics Class X E-71